The domestication of wild grains has played a major role in human evolution, facilitating the transition from a hunter-gatherer lifestyle to one based on agriculture. You might think that the grains were used for bread, which today represents a basic staple. But some scientists argue that it wasn’t bread that motivated our ancestors to start grain farming. It was beer. Man, they say, chose pints over pastry.Makes sense to me.

Beer has plenty to recommend it over bread. First, and most obviously, it is pleasant to drink. “Beer had all the same nutrients as bread, and it had one additional advantage,” argues Solomon H. Katz, an anthropology professor at the University of Pennsylvania. Namely, it gave early humans the same pleasant buzz it gives us. Patrick E. McGovern, the director of the Biomolecular Archaeology Project for Cuisine, Fermented Beverages, and Health at the University of Pennsylvania, goes even further. Beer, he says, was more nutritious than bread. It contains “more B vitamins and [more of the] essential amino acid lysine,” McGovern writes in his book, Uncorking the Past: the Quest for Wine, Beer, and Other Alcoholic Beverages. It was also safer to drink than water, because the fermentation process killed pathogenic microorganisms. “With a four to five percent alcohol content, beer is a potent mind-altering and medicinal substance,” McGovern says, adding that ancient brewers acted as medicine men.

In fact, McGovern has found that the ancients used beer as medicine. Working with the Abramson Cancer Center of the University of Pennsylvania, McGovern discovered traces of sage and thyme in ancient Egyptian jars. Luteolin, which is in sage, and ursolic acid, which is in thyme, both have anti-cancer properties. Similarly, artemisinin and isoscopolein from wormwood fight cancer, and were found in ancient Chinese rice wine. “The ancient fermented beverages constituted the universal medicine of humankind before the advent of synthetic medicines,” McGovern says......The great advantage of grain is that it didn’t spoil like fruit or berries, and could be kept for months and used as needed. That motivated our ancestors to build permanent structures to store their grains and homes close to their fields—which in turn led to the creation of villages. Archeologists have found stone silos dating from the Neolithic to the Bronze Age at sites in the Middle East.

Saturday, December 21, 2013

Beer's Role in the Civilization of Man

Nautilus:

My Speech Gives Me Away

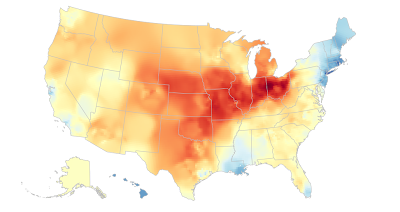

Try out this dialect test. It said my speech was most similar to Dayton, Fort Wayne or Springfield, Missouri. Pretty accurate there. And if you look at the map, west central Ohio is brick red.

Why The Dairy Cliff Won't Materialize

Because it would be a stupid pain in the ass:

U.S. farm law is set by a 1949 act that includes hefty price supports for dairy farmers. Those supports were once needed because dairy prices often weren’t high enough to cover the costs of production. The law directs the federal government to buy milk, butter and cheese, artificially inflating prices to prop up farmers.The Farm Bill is one of the better examples that Congress is full of clowns. They've had forever to bang out a farm bill, and they are still unable to get anything done. And the kicker is that the reactionary morons from rural areas in the House decided to hack the food stamps out of the bill, which was the only reason the Congressmen representing areas with sustainable population densities had any interest in passing a Farm Bill. What a bunch of asshats.

But the “permanent law” is superseded by the farm bills Congress is supposed to pass roughly every five years. Not surprisingly, the current Congress has had some trouble reaching an agreement this time around, and the farm bill is now ridiculously late. A one-year extension at the end of last year wasn’t enough, and congressional leaders have said the bill will be taken up in January. Theoretically, that means a reversion to the “permanent law,” which would force the Department of Agriculture to start buying dairy products at (perhaps) about double their current prices on January 1. Hence the headlines warning that a gallon of milk is about to shoot up to anywhere between $6 and $9 a gallon, depending on which account you believe. There were even more scary “dairy cliff” headlines last year, before the extension was passed. We weren’t any close to the edge then than we are now.

Like the debt ceiling, the “permanent law” carries the “threat that it’s such a goofy law that Congress will pass a new one and rewrite the rules and not go back to the old rules,” Kent Olson, a University of Minnesota Extension economist, told Minnpost.

Secretary of Agriculture Tom Vilsack, though, has said that he won’t implement “permanent law” as long as Congress continues debating the farm bill in January, which they will be doing. And even if we were to go over the dairy cliff, Vilsack has any number of options for stalling price supports. It’s not like the federal government can suddenly just start buying (and storing) vast amounts of dairy products.

Friday, December 20, 2013

The Holy Foreskin

Really:

Relics played an important role in medieval Christianity. The physical remains of saints and holy figures were considered an essential part of the faith, offering a powerful connection with Heaven.....Now that's a new one on me. I knew that in the old days that New Year's Day was the feast of the Circumcision prior to it being changed to the feast of Mary, the Mother of God, but I'd never heard about the Holy Foreskin.

The most important relics were those associated with Jesus Christ – such as the True Cross where he died upon, or the mother’s milk of Mary. However, since Jesus was said to ascend to Heaven with his body, there could not be any of his own bodily remains left – except, perhaps, those that he left behind before he was killed, such as his blood or his finger nails.

All this brings us to the story of Jesus’ circumcision, which the Roman Catholic Church celebrated eight days after his birth on January 1st. Following the Jewish rite, Jesus was circumcised, which leaves the question of what became of his foreskin.

Very few articles have been written on the topic of the Holy Foreskin, partly because in the year 1900 the Roman Catholic Church threatened to excommunicate anyone who did so. However, Robert Palazzo bravely did his research and his article “The Veneration of the Sacred Foreskin(s) of Baby Jesus: A Documentary Analysis,” offers some interesting details about this relic. He notes that apocryphal gospels, such as the The First Gospel of Baby Jesus, which was written sometime before the 6th century, described how the foreskin was kept and passed down from generation to generation.

By the eleventh century, several churches in Europe explained they had the Holy Foreskin – the story often went something like this – Jesus’ mother Mary kept the foreskin, along with the umbilical cord, and later gave it to Mary Magdalene. We then jump forward several centuries to the time of Charlemagne, when an angel gave the relic to the Emperor. From there it went to this place or that place, including to Rome. In 1421, it was even sent to Cathernine of Valois in England, so that it would bring good fortune (and a pregnancy) to her marriage with Henry V.

Palazzo has been able to find at least 31 churches in Europe that claimed to have the Holy Foreskin sometime during the Middle Ages, including ones in Paris, Antwerp, Bologna, Compostela and Toulouse.

Meanwhile, one can also read a lot of theological commentary about whether or not the Holy Foreskin could be real, much of it negative.

U.S. Men Qualify for Olympic Curling Tournament

Minneapolis Star-Tribune:

Winning the U.S. Olympic curling trials should have been cause for celebration, but John Shuster and his crew knew their task was only half complete. The Duluth skip and his Minnesota teammates still had to qualify for a place in the 2014 Winter Olympics, leaving them with some serious work to do before the party could start in earnest.I started watching the match last night, but I only made it through about 12 stones before I fell asleep. At least this will guarantee a decent amount of curling coverage on TV.

The foursome finally got to raise that long-delayed toast Sunday. They rallied to beat the Czech Republic 8-5 in the last game of the Olympic qualifying tournament in Fuessen, Germany, to claim the final spot in the Sochi Olympics. Shuster and teammates Jeff Isaacson of Gilbert, Jared Zezel of Hibbing and John Landsteiner of Duluth won five consecutive games to end the tournament and came back from a 3-2 deficit late in the final match.

Shuster earned his third consecutive trip to the Olympics in dramatic fashion. His team trailed after seven of 10 ends in a tense, back-and-forth game, then scored five in the eighth end to take command. Their victory puts four more Minnesotans on the Olympic team; the women’s curling team, which already had locked up its berth, includes Jessica Schultz of Minneapolis and alternate Allison Pottinger of Eden Prairie.

“The butterflies of winning for an opportunity like this, they never get old,’’ said Shuster, 31, who won a bronze medal at the 2006 Olympics as the lead for Pete Fenson’s team. “That’s why we play this game. I’m extremely proud of how well our team has played the entire season, and especially here, when we had our backs against the wall.’’

Shuster’s team won the U.S. Olympic curling trials in November in Fargo, N.D. It was forced into the eight-team qualifier because the U.S. was ranked eighth in the combined standings of the past two world championships. The top seven teams, plus Russia as the Olympic host, earned automatic berths in the 10-team Olympic tournament.

The final two teams were decided via the qualifier. After a 2-2 start — including a loss to the Czechs in Tuesday’s opener — Shuster’s team won three consecutive games. Germany and the Czech Republic topped the standings and played for the first Olympic spot, while the U.S. had to beat Korea in a Saturday tiebreaker to keep its hopes alive.

Thursday, December 19, 2013

The Cincinnati Stadium Screw Job

Another article discussing the crazy public subsidies for professional sports stadiums features Cincinnati:

When voters approved a sales-tax increase to pay $540 million toward stadiums for Cincinnati’s professional baseball and football teams almost two decades ago, city leaders promised lower property levies and a business district along the Ohio River.And not only has Mike Brown screwed Hamilton County taxpayers (and the IRS), he's been a complete asshole while doing it, and the Bengals have failed to win a playoff game since he took over the team.

The tax relief hasn’t materialized as pledged, said Todd Portune, a commissioner in Cincinnati’s Hamilton County. Instead, the county government is grappling with annual stadium expenses totaling at least $43 million this year, including debt service, county documents show. Residents have seen a public hospital sold, mass-transit investments postponed and little private development near the stadiums that didn’t involve additional public subsidies, Portune said......

In Cincinnati, Bengals owner Mike Brown took control of the team in 1991, after the death of his father, Paul Brown, a Hall of Fame founder and coach of the Cleveland Browns, who in 1967 headed an ownership group that acquired an expansion franchise in the American Football League. The Reds are owned by Robert Castellini, who led a group that bought a team after the 2005 season that was then valued at $270 million. The team is now worth $680 million, according to a data compiled by Bloomberg.

In the 1990s, each team began pushing for public funding to replace Riverfront Stadium, which opened in 1970 and was shared by both organizations. In March 1996, Hamilton County voters approved a half-percentage point increase in their sales-tax rate to fund the football and baseball venues as part of an effort to revive the area along the Ohio River.

Paul Brown Stadium opened for the Bengals in 2000 and Great American Ball Park opened for the Reds in 2003. The stadiums are about a half-mile apart......

Public costs for Cincinnati stadiums now exceed $1 billion in 2010 dollars, according to Long, the Harvard professor, who tabulated expenses for stadiums for a book titled “Public Private Partnerships for Major League Sports Facilities.”

The NFL stadium proved particularly costly, according to Long. Paul Brown Stadium was the second-most expensive public deal of any U.S. stadium, according to her data, with the public paying $706 million, including land, infrastructure, maintenance and tax breaks. It trails only Indianapolis’s Lucas Oil Stadium. Taxpayers also spent about $489 million on the Reds’ Great American Ball Park, according to Long’s data.

Why Barry Bonds Belongs in the Baseball Hall of Fame

Jonah Keri:

1. Barry Bonds: On numbers alone, Bonds is one of the three or four best players of all time, and that's before factoring in the quality of competition in his era compared to what Babe Ruth and Ty Cobb faced. Of course, Bonds's candidacy isn't nearly that simple for many voters or fans. OK, let's assume that, despite there being no positive drug test, Bonds took PEDs. Since the two most common arguments pointing to Bonds's PED use are that (a) his numbers shot to the moon at an age when that very rarely happens, and (b) he went from being an athletic, all-around terror to a gigantic home run machine, let's also assume that Bonds started juicing after the 1999 season. That would square with the popular narrative that Bonds was jealous of the attention going to Mark McGwire and Sosa in '98, and that an injury-plagued '99 season would've pushed Bonds to seek chemical help while rehabbing. To further extend this exercise, let's assume that Bonds deserves absolutely zero credit for everything that happened from 2000 on. His remaining career numbers would be:His footnote points out that Ken Griffey, Jr. was second in WAR from 1986-99, at 68.5. To slightly correct that, Griffey only played from 1989 on, so I'd add the next three years of WAR to the total for Griffey. Unfortunately for him, those were his first three years in Cincinnati, which only netted him an additional 6.8, for a total of 75.3 (although it is notable that he had 5.5 WAR in his first season in Cincinnati, which was better than his last season in Seattle). Bonds first 14 years are still amazing. And honestly, I don't care if he was juicing or not, Bonds' 2001-2004 were the most impressive four seasons I've ever watched. Just like McGwire and Sosa were the most exciting things in 1998, I've got to say that doping or not, it was damn fun watching Bonds at his doping peak. I've pummeled Lance Armstrong for being a doping motherfucker, but honestly, his performance was amazing. It was just his sociopathic lying and ridiculously brutal attacks on others who were a little more honest about their and his doping that was so terrible.

2,000 games playedBonds's first 14 years work out to the sum of Jimmie Foxx's entire career. And of course, this exercise twistedly assumes that without PEDs, Bonds would've been eaten by wolves on Christmas Day 1999 and never played again.

445 home runs

1,299 RBIs

1,455 runs scored

460 stolen bases

.288/.409/.559

3 MVPs

102.5 WAR3

Some will argue that players linked to steroids should automatically be disqualified for life from Hall consideration and that even suspicion of use absent a failed test or other concrete evidence should trigger that ban. Those aren't the standards I use to evaluate players' Hall cases, though, so Bonds is the easiest pick for me this year.

Wednesday, December 18, 2013

An Ancient Battle

Physicists and archaeologists are fighting over ancient Roman lead (yeah, really):

Archaeologists and physicists are at loggerheads over ancient Roman lead—a substance highly prized by both camps for sharply diverging reasons. Very old lead is pure, dense and much less radioactive than the newly mined metal, so it is ideal for shielding sensitive experiments that hunt for dark matter and other rare particles. But it is also has historical significance, and many archaeologists object to melting down 2,000-year-old Roman ingots that are powerful windows on ancient history.....Wow, I definitely didn't know any of that.

Ancient Roman lead has been used in the Cryogenic Dark Matter Search (CDMS), an experiment in Minnesota that aims to detect the particles that make up the invisible dark matter thought to contribute much of the universe's mass. The same metal has also been used in the CUORE (Cryogenic Underground Observatory for Rare Events) project in Italy, which will soon begin searching for a theorized particle decay process called neutrinoless double beta decay, which, if found, could explain why matter dominates antimatter in the universe. These experiments and others require extreme shielding to block out any extraneous particles that might be mistaken for the rare signals they hunt.

The lead in question once went into the making of coins, pipes, construction materials and weapons in the ancient Roman civilization. It is most commonly found now at shipwreck sites, where private companies harvest it and melt down the Roman ingots into standard bricks before passing them on to customers—many of whom are physicists. "None of us take it casually—you don’t want historical artifacts to be destroyed unnecessarily," says physicist Blas Cabrera of Stanford University, who leads the CDMS project. Nevertheless, ancient lead is the best material available for shielding dark matter detectors, he says, because it releases so little radiation, or background particles. "The kind of background levels that you're achieving with ancient lead are roughly 1,000 times below that of commercially available lead."

All lead mined on Earth naturally contains some amount of the radioactive element uranium 235, which decays, over time, into another radioactive element, a version of lead called lead 210. When lead ore is first processed, it is purified and most of the uranium is removed. Whatever lead 210 is already present begins to break down, with half of it decaying on average every 22 years. In Roman lead almost all of the lead 210 has already decayed, whereas in lead mined today, it is just beginning to decay.

An Abandoned Subway AND an Abandoned Streetcar?

Cincinnati may have both:

As Jalopnik recently reminded us, Cincinnati is home to the "largest abandoned subway system in the United States." Construction of the planned 16-mile system began in 1920 and halted in 1925 when the initial funding of $6 million ran out with the project not quite halfway done. Almost a century and a few failed revivals later, two miles of unused tunnel still run below Central Parkway, one of the main roads through the city.

Geez, they've already spent about 25% of the construction cost. This would be a very good thing for the redevelopment of Over-the-Rhine and I really hate the idea of the city killing it. But, as the story notes, there's 2 miles of abandoned subway under Central Parkway, so just about anything is possible.

If Cincinnati isn't careful, its in-progress streetcar system might face a similar fate. Whether or not to finish that project was at the heart of the city's recent mayoral election. Stop-construction candidate John Cranley emerged victorious, and earlier this month the city council put the 3.6-mile project on indefinite pause despite about a half-mile of track already laid.

It can't stay on pause much longer. The Federal Transit Administration, which issued Cincinnati roughly $45 million in funding for the project, has asked for a decision on the project by the end of Thursday.

The big issue for Cranley and the city council is whether local taxpayers should be on the hook for potential operating costs. The new mayor has said he's willing to let construction continue if private donors come up with enough cash to pay for the first 30 years of running the system — a figure that's reportedly around $80 million. The auditing firm KPMG is expected to release results of a cost analysis sometime today.

Tuesday, December 17, 2013

More Crazy Numbers

Ritholtz features a couple of great charts on income inequality. This one relates to the video in the previous post:

$5 billion in a year? That is so fucking ridiculous that I just don't have words to describe it.

$5 billion in a year? That is so fucking ridiculous that I just don't have words to describe it.

Family Budgets, In and Out of the Social Safety Net

Via The Atlantic Cities:

This month, the Bureau of Labor Statistics compared yearly spending between families that use public assistance programs, such as food stamps and Medicaid, and families that don't. And surprise, surprise, households that rely on the safety net lead some pretty frugal lifestyles. On average, they spend $30,582 in a year, compared to $66,525 for families not on public assistance. Meanwhile, they spend a third less on food, half as much on housing, and 60 percent less on entertainment.But that surfer on Fox News buys lobster, so we know folks in government programs have it easy! I think I'll pay my taxes and be happy I'm not struggling to rotate which bills to pay this month. Then again, because of how the tax laws are structured, I can stash away over $16,000 in a tax deferred 401K account while folks I know try to raise children on not much more than that in income. I've told conservatives I know that they can quit their jobs and take government programs if it is such a good deal, but they say they are too proud. Also, that might cut into their Keno playing funds.

These figures, drawn from the 2011 Consumer Expenditure Survey, don't capture all non-cash perks some low-income families get from the government, such as healthcare coverage through Medicaid. But they give you a sense of the kind of tight finances these families deal with.

Monday, December 16, 2013

Farmers Hoarding Corn

WSJ, via Big Picture Agriculture:

Faced with the lowest corn prices in more than three years, many U.S. farmers are stashing away their grain in a bet on a rebound.I don't see this ending well, and this is one of the biggest reasons I'm pretty bearish about the next couple years' corn crops. I just don't see anything to drive prices higher for a while. Also from Big Picture Ag are a couple of farmland price stories. The fact that a big pension fund is buying a huge parcel of farmland is a contrarian indicator in my opinion. As for Iowa, I don't know what's going on there:

The strategy is sending ripples through the corn belt—affecting everyone from grain buyers to storage-bin makers—and tempering the price declines in the $27 billion corn-futures market.

By hoarding freshly harvested supplies, farmers are forcing livestock producers, ethanol companies and food makers to pay a premium over futures in some areas to secure corn, helping to buoy prices during what is expected to be a record U.S. harvest, traders and analysts say. But they warn the move could backfire on farmers in coming months if rival producers—such as growers in South America—generate big crops or demand for corn falls.....

Mary Ann Kwiatkowski, an independent grain trader at the Chicago Board of Trade, says she is "a little less bearish" on corn futures because of the farmers' strategy. Because storing corn leads to higher cash prices, it will cause investors to be less willing to bet on declines in corn futures, she says."Farmers have had a lot of years of doing very well," says Craig Turner, a senior broker at Daniels Trading in Chicago, "and they can use the bins as a bank account and only sell when they need to. Having the storage has helped with the price not coming down as much as it would have. It helps stabilize the price."But analysts say corn growers are taking a big risk, noting that favorable weather so far this season for rival farmers in Brazil and Argentina could lead to large crops in the new year, which could further expand global supplies and exert even more downward pressure on prices.The corn stockpiles also act as an overhang on the market. Farmers eventually will have to sell their grain, Mr. Turner says, and when they do, the added supplies will weigh on prices.The USDA estimated in November that U.S. corn production will total 13.989 billion bushels this year, easily surpassing 2009's crop, the largest so far. The massive harvest comes just a year after the worst U.S. drought in decades curtailed output and vaulted corn futures to a record-high closing price of $8.3125 a bushel.

WTF? Has anybody out there tried to make those numbers work with corn under $4?

The Pope Lottery

60 Minutes featured two stories last night. One was a pro-NSA propaganda piece, and the other was about the Coptic Christians of Egypt, who elect a pope by whittling the field down to three candidates, then having a boy select one of three balls with a candidate's name in it to determine the pope:

Google Buys Boston Dynamics

Boston Dynamics is a premier robotics research operation, and the eighth robotics company Google has purchased:

Google just acquired Boston Dynamics. It’s the eighth robotics company the California tech titan has purchased in six months and, by far, the most significant. For two decades, Boston Dynamics has produced some of the world’s most advanced robots.

Neil Jacobstein, co-chair of the Artificial Intelligence and Robotics Track at Singularity University, told Singularity Hub, “This is a watershed event. A very big deal. Google is buying up high potential robotics companies. Boston Dynamics is the pick of the litter.”

Even if you don’t follow technology or robots closely, you may have watched one of their viral videos with some combination of awe, fear, and the realization that robots are nowhere near as clunky as you thought they were.

The firm’s humanoid Atlas and Petman robots can balance on two legs, walk, and do calisthenics. Video of an uncannily human Petman in fatigues—the robot was built to test chemical warfare gear—drew over three million views earlier this year.

Beyond the bipedal, the company’s Cheetah robot runs faster than Usain Bolt; their WildCat robot recently took Cheetah’s tricks beyond the treadmill; their robot SandFlea leaps onto tall buildings; and LS3 autonomously follows soldiers across rough terrain, carrying gear and supplies on its back. (Check out the full roster here.)Wow, Petman is creepier than Asimo. More Boston Dynamics robot videos here and here and here

The Boston Dynamics bots are rugged and multi-functional. And while many robotics firms are doing inspiring work, none have produced a complete package that so closely resembles the popular image of what a robot should be.

Google, meanwhile, has billions at its beck and call. They make clever algorithms with designs on artificial intelligence, own the most sophisticated self-driving car on the road, and write paychecks to AI luminaries like Geoffrey Hinton and Ray Kurzweil.

It’s simple addition to see why the deal is making headlines.

Some folks look on some of Boston Dynamics’ creations with trepidation because they have largely been funded by the Defense Advanced Research Projects Agency (Darpa). But Boston Dynamics founder, Marc Raibert, has said he doesn’t consider his firm to be part of the military industrial complex. They’re just trying to take robotics to the next level.

Sunday, December 15, 2013

NASA Photo of the Day

December 13:

Geminid Meteor Shower over Dashanbao Wetlands

Image Credit & Copyright: Jeff Dai

Explanation:

The annual Geminid meteor shower

is raining down on planet Earth this week.

And despite the waxing gibbous moonlight,

the reliable Geminids

should be enjoyable tonight (night of December 13/14)

near the shower's peak.

Recorded near last year's peak in the early hours of

December 14, 2012, this

skyscape captures

many of Gemini's lovely shooting stars.

The careful composite of exposures was made during a three hour

period overlooking the

Dashanbao Wetlands in central China.

Dark skies above are shared with bright Jupiter (right), Orion,

(right of center) and the faint band of the Milky Way.

The shower's radiant in the constellation Gemini, the apparent

source of all the meteor streaks, lies just above the top of the frame.

Dust swept up from the orbit of

active asteroid

3200 Phaethon,

Gemini's meteors enter the atmosphere traveling

at about 22 kilometers per second.

Image Credit & Copyright: Jeff Dai

Bitcoin Chart of the Day

Daily number of Bitcoin transactions versus Bitcoin market capitalization in dollars:

This chart shows a dramatic reduction in the total number of transactions, irrespective of size, per dollar of bitcoin’s market cap, from December 2012 – December 2013. In absolute terms, market cap has generally gone up, and the number of transactions has mostly just bounced around a lot. The total value of bitcoin is going up, but it’s mostly getting parked rather than being put to work. Apparently there just aren’t a lot of appealing ways to spend bitcoin, anecdotal news stories to the contrary notwithstanding.Yes, it is a speculative bubble. People are hording the things. They won't hold their value.

Instead, an increasing amount of bitcoin’s putative value (as measured in USD) is being squirreled away by larger and larger miner-investors. It’s not fueling a diversifying, all-bitcoin economy: if it were, transactions would be keeping up with or even outpacing market cap, particularly if bitcoiners came to rely increasingly on bitcoins and decreasingly on dollars for day-to-day purchases. That’s very clearly not happening.

Instead, people are mining additional bitcoin, and speculators are buying in – and thus both of them are growing bitcoin’s notional market cap – but these folks simply aren’t adding all that much to the number of daily transactions. Even a bitcoin mining pool would only disburse its proceeds once, and if the individuals in the pool mostly just held their bitcoin, you’d get a graph a lot like the one above.

Stagg Bowl Matchup Set

Mount Union squeaked by North Central, 41-40, while UW-Whitewater got by Mary Hardin-Baylor, 16-15, to advance to the Division III championship game. This is the eighth matchup between the two schools in the championship game in the last nine years. The only exception was last year's matchup between St. Thomas and Mount Union. It is also Mount Union's ninth straight appearance in the championship game, their 16th appearance in the last 18, and their 17th in the last 21. That is a pretty ridiculous run.

Labels:

Football,

Local history,

Smaller is Better,

Strange But True

Lawmakers Push To Remove Corn From Ethanol Mandate

Expect more of this:

A bipartisan group of lawmakers has introduced legislation that would eliminate corn from the country’s ethanol mandate requirement.If they do this, expect a severe drop in corn prices and numerous ethanol plant closings. I'm pretty sure the strength of Big Corn and their ethanol juggernaut has peaked. The at least short-term growth in oil production due to shale oil has strengthened Big Oil to go after their mortal enemies in the grain alcohol industry.

The bill, introduced by Sens. Dianne Feinstein, D-Calif., and Tom Coburn, R-Okla., would greatly diminish the prominence of the Renewable Fuel Standard by removing the component that requires fuel to be made from corn. Smaller mandates for advanced biofuels such as cellulosic would remain in place. The Renewable Fuel Standard, put in place in 2005 and strengthened two years later, requires refiners to blend 16.55 billion gallons of biofuels in 2013, most of it from corn.

The 10 senators, all of them from states that are not major corn producers, said the maize component of the Renewable Fuel Standard has made food more expensive for consumers, pushed up the cost of animal feed for livestock farmers and harmed the environment.

The head of Growth Energy, which represents the ethanol industry, called the legislation “incredibly shortsighted.”

Banking's Big 4

From Businessweek:

Don’t be so sure. Five years after the system was held at gunpoint by a massively interconnected and over-risked Wall Street, the country’s six biggest banks—JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Wells Fargo (WFC), Goldman Sachs (GS), and Morgan Stanley (MS)—are now 37 percent larger than they were in the depths of the financial crisis. These institutions make more than four out of every 10 loans and tote two-thirds of the banking system’s $14.4 trillion in assets, according to WkndNotes, a private newsletter e-mailed to traders and brokers by investor Eric Peters....JPMorgan Chase is about the size of the entire British economy and holds 12 percent of all cash in the U.S. Unpack its corporate letterhead and you will find old Fortune 500 stalwarts like Washington Mutual, Providian, Chemical Bank, Banc One, Bear Stearns, and Great Western, among many other absorbed institutions. Bank of America, which snapped up Countrywide and Merrill Lynch (and pretty much all Merrill Lynch has snapped up) accounts for about a third of all U.S. business loans, while Wells Fargo (think Wachovia-First Union-CoreStates and the Money Store) makes a quarter of all mortgage loans.This is not quite the era of the Trusts, but these four are huge.

North Dakota Oil Production Sets New Record

National Journal:

I'm just curious where the peak will be. The furthest out projection I've seen is 2020, but I would guess it would be much sooner. Then again, predictions of well production falloff may be grossly pessimistic. Only time will tell. However, when the Eagle Ford and Bakken peak, expect to see spiking oil prices.Oil output in North Dakota reached a record high for the state in October, with production rising to just over 941,000 barrels per day, according to data released by the North Dakota Department of Mineral Resources.Natural-gas output also climbed to a high of slightly more than 1.07 billion cubic feet per day."We set a new production record again in October and had a well-record both in oil and natural gas," Lynn Helms, the department director, said during a press call Friday.Helms noted, however, that the uptick in production from September to October, which registered as an increase of approximately 8,600 barrels per day, was less than expected."It was maybe a little bit lackluster in terms of the production increase, less than what we would have maybe anticipated for the amount of drilling and well-completion going on out there," he said.Heavy rains in North Dakota's McKenzie County leading to road closures that lasted several days were to blame for tepid production gains, Helms said, estimating that output would likely have been 10,000 to 15,000 barrels a day higher in dry weather.When asked when he expects the state to hit the production threshold of 1 million barrels of crude per day, Helms said that will likely happen early next year as state officials have previously estimated."We've always been predicting that that would come early next year so even with what happened in October ... all it does is postpone it. It doesn't mean we're not going to get there," he said.

Subscribe to:

Comments (Atom)